Up to 10 of aggregate income. You can donate to us via our official donation page.

Chapter 5 Tutorial Taxation Chapter 5 Corporate Taxation Exercise 5 Corporate Tax Quick Notes Studocu

Where can donation under subsection 446 of the ITA 1967 be channeled.

. APPROVED DONATIONS GIFTS LIMIT Gift of money to Government or Local Authority NONE Cash donation paid to approved institutions or organisations Gift of money orcontiibutioninLkino to any sports activity or approved 700 OF sports body Gift of moneyorcostofcontribution AGGREGATE INCOME in-kind to any project of national interest. Bill Payment Available in Maybank2U CIMBClicks and HSBC Online. Approved donations gifts contributions.

A business entity in Malaysia is subject to the Income Tax Act 1967 ITA 1967 to pay taxes for any income generated through its operations. Thank you for supporting MERCY Malaysia. Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body.

National Disaster Management Agency Prime Ministers Department. Gift of money to Approved Institutions or Organisations. Gift of money to approved institutionsorganisationsfunds.

Ethis Malaysia Ethis Malaysia which is part of Ethis Group is a Recognized Market Operator RMO approved under Securities Commission Malaysia to carry out Equity Crowdfunding business activities. SSL has established a few diverse centres in Petaling Jaya. Donations to charitable institutions A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment.

Gift of money or cost of contribution in kind for any Approved Project of National Interest Approved by Ministry of Finance. Doing charitable works also foster a sense of. Organisation or fund approved for the purposes of subsection 44.

Subsection 44 6 2. Institution or organisation or fund approved under subsection 446 of the ITA 1967. Gift of money for any approved sports activity.

In Malaysia companies can claim up to 10 of tax deduction. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. CYBERJAYA March 26 Tax deduction incentives will be given to those who donate cash or items that will be used to contain the spread of Covid-19 and to help the people affected by the outbreak said Inland Revenue Board IRB.

Therefore the 7 tax deduction varies depending on ones annual income. The centre has been continuing its mission to provide subsidised haemodialysis service to the underprivileged society since 1994. Offer a helping hand to those in need by starting a non-profit organization in Malaysia.

Donations that fall under the following categories are restricted to 10 of your aggregate income. Charity in society is an essential way to ensure that the community can sustain itself. Payment Type Personal Info.

Should an approved institution or organisation or fund reapply for the. Offline Donation - Download our donation form here and send it to the address stated in the form. Maximum claim amount is 25 of the aggregate.

Starting a non-profit organization in Malaysia is an honourable goal many aspire towards. Sau Seng Lum is a leading non-profit health system in Malaysia. Any company that is registered with the Companies Commission Malaysia aka.

Youre 3 simple steps away from helping us to respond faster and better to the people in time of need. Go to Bill Payment search biller name WWF Malaysia. 1 Donations to charities sports bodies and other approved projectsfunds.

A holding company in Malaysia is a type of corporation that does not provide any services and does not manufacture any items on its own behalf. The IRB in a statement today said the incentives provided under the Income Tax Act 1967 were for the Ministry of Healths Covid-19. Suruhanjaya Syarikat Malaysia SSM is required to pay corporate tax to avoid penalties for non-compliance with the tax law.

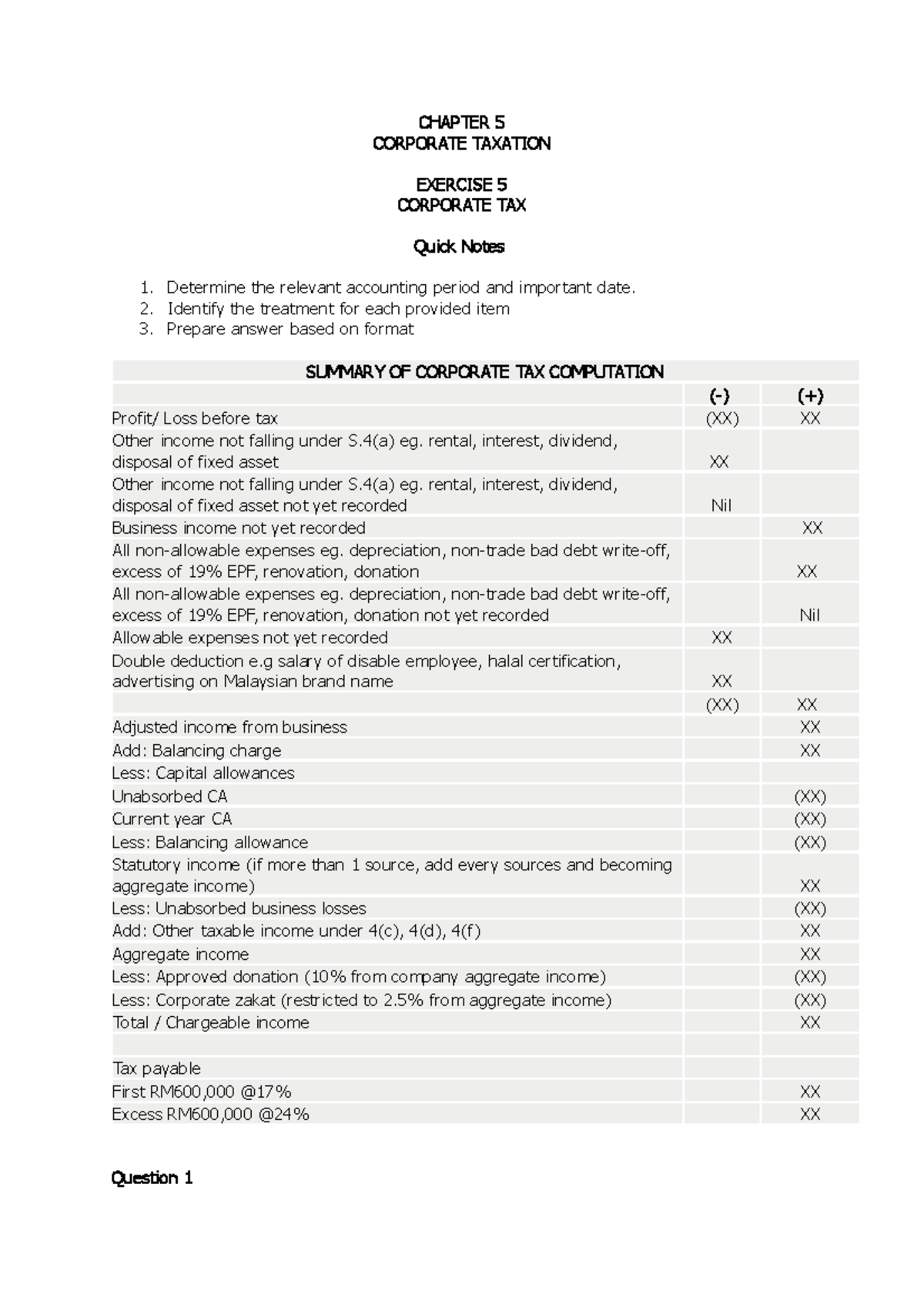

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. We are best known for our crowdfunding impact investment for Indonesian social housing development projects which has been operational since 2014. Amount is limited to 7 of aggregate income Subsection 44 6 3.

Gift of money to the Government State Government or Local Authorities. Fines and penalties Fines and penalties are generally not deductible. Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body.

So if you donate RM4000 to a charity only RM3850 is deducted from the total taxable income. This maximum limit ensures that you dont pay any less to the government. Pursuant to section 2 of the ITA 1967 most business entities are generally taxable given the wide definition of a taxable person.

Fill up details required by. Amount is limited to 10 of aggregate income Subsection. Amount is limited to 10 of aggregate income Subsection 4411B 4.

With cash donations MERCY Malaysia is able to purchase supplies in local regions or closer to the affected areas. 3E Accounting offers a quick 101. The deduction is limited to 10 of the aggregate income of that company for a year of assessment.

Resident companies are taxed at the rate of 24. A holding company in Malaysia is a legal entity that is created for the purpose of controlling and managing the investment policies and assets of another firm. This ensures that donation from the public is channeled to the people who need it most and not utilised unnecessarily to cover logistic costs such as transportation fuel and warehouse space rental.

Don T Fall Prey To The Fake Charity Collectors Here S How To Identify

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Updated Guide On Donations And Gifts Tax Deductions

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Aggregate To Total Income Acca Global

Updated Guide On Donations And Gifts Tax Deductions

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Ways Of Establishing A Foundation In Malaysia Azmi Associates

Ktp Company Plt Audit Tax Accountancy In Johor Bahru